Published in the Post Register.

Just what is return on investment (ROI)?

When we talk about it in money terms, we’re usually talking about profitability. How much financial profit do we get when we invest our dollars?

Investing in communities, though, is an entirely different proposition.

Too often, we fall into the trap of assuming that a government should be run like a business. However, the government isn’t a business. Goals and outcomes are different — and they should be.

Rather than identifying and investing in profit centers and hoping for a return on investment in terms of revenue and profit, the government is meant to invest in communities. The return isn’t always a straight line to dollar returns, however.

When we invest in communities, the returns are often in an educated and productive workforce, public safety and health. It’s hard to quantify your quality of life, but that’s the main advantage of government investment in our communities.

That’s not to say that there are no monetary considerations when you invest in our communities. For example, for every dollar spent on early childhood education, the Learning Policy Institute research indicates that we reap about $7.30 in economic benefits down the road. A better-educated citizenry and workforce contribute to long-term economic benefits that aren’t readily apparent just by looking at next year.

What about infrastructure? Well, according to a research review cited by the Economic Policy Institute, every $100 invested in infrastructure boosts private-sector output by an average of $17 in the long run. That’s right, we get an extra boost, on top of what’s already there, when the government invests in infrastructure.

So, where do tax cuts fall? Well, an analysis by the Congressional Budget Office, ranking 11 different methods of economic stimulus, places tax cuts at number 11.

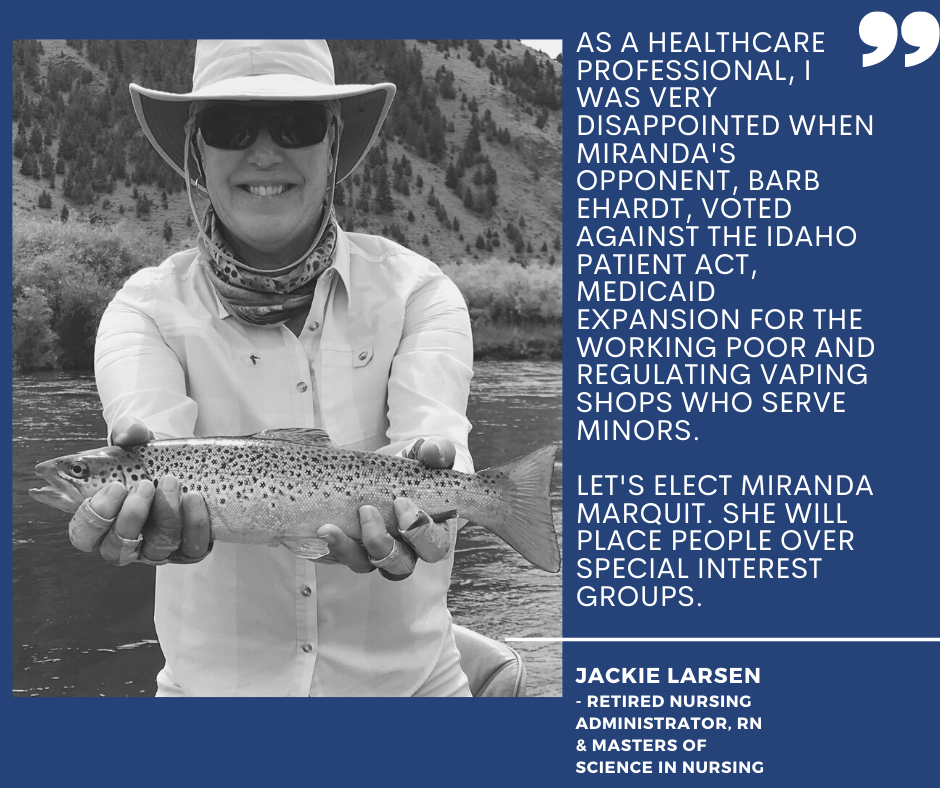

Investing in our people, in our communities, provides us with benefits that we just don’t see when we let everyone fend for themselves. We poo-poo government safety net investments like food assistance and Medicaid. However, the incidence of fraud in these programs is low, and they help our communities in ways that private charity can’t. Indeed, research from Indiana University found that only 30% of charitable giving focuses on the poor and alleviating the issues they face.

It’s for us to take a look at our leaders and ask them to invest in us. We’ve been demanding that they invest in education. They aren’t. We ask them to invest in infrastructure. They don’t. We had to force them to invest in affordable healthcare by passing Medicaid expansion. And they still spend more time trying to get out of their obligation than they do addressing affordable housing issues.

We have a historic surplus in our state right now. But, as my friend David Roth points out, is it truly a surplus? Or is it the result of years of under-investing in our communities and our people? It’s time for our so-called leaders to stop giving tax cuts to their wealthy donors and friends. It’s time for them to invest in Idaho.

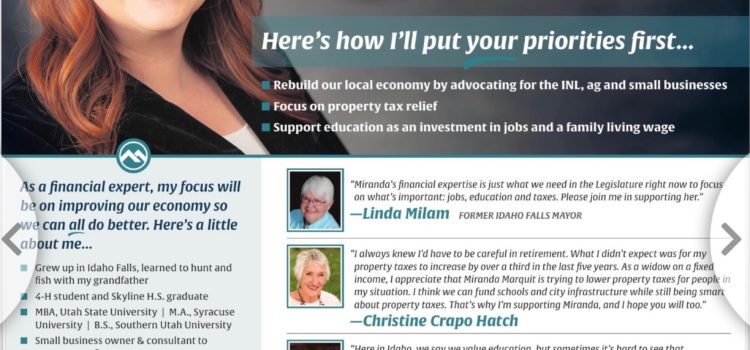

Miranda Marquit, Master of Business Administration, is a nationally recognized financial expert, writer, speaker and podcaster. She is the state committeewoman for the Bonneville County Democratic Central Committee.